Lloyds Bank in Bitcoin crackdown: credit card owners banned from buying cryptocurrency

Britain’s biggest bank has become the first to announce a ban on customers using credit cards to buy Bitcoin amid fears they could run up huge losses.

Lloyds Banking Group will on Monday tell its 9 million credit card customers that it will block any attempts to buy Bitcoin after the digital currency lost more than half its value in just two months.

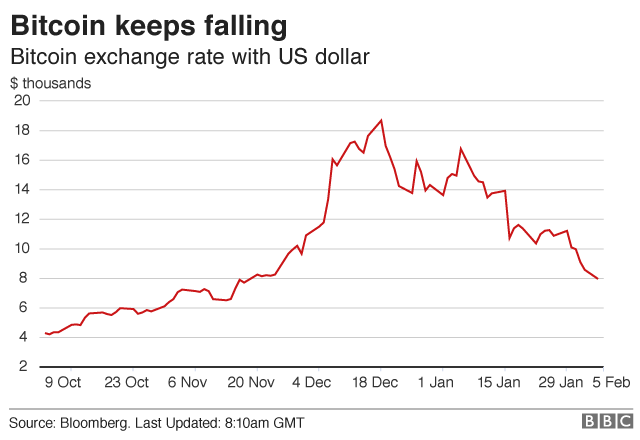

The price of Bitcoin has fallen by 57 per cent from £14,000 in December to less than £6,000 and the bank fears it could end up footing the bill for unpaid debt should the price fall any lower.

It is believed that hundreds of thousands of British people invested in the cryptocurrency last year amid its extraordinary 13-fold increase.

But from Monday credit card customers of Lloyds, which includes Halifax, Bank of Scotland and MBNA, will be blocked from buying the cryptocurrency online via a blacklist which will flag up sellers. While Lloyds is…

Virgin Money has joined Lloyds Banking Group in banning customers from buying Bitcoin and other digital currencies with their credit cards.

Virgin Money’s spokesperson said: “Following a review of our policies, I can confirm customers will no longer be able to use their Virgin Money credit card to purchase crypto-currencies.”

Like Lloyds, Virgin’s ban only applies to its credit cards, not debit cards.

The value of Bitcoin fell a further 10.86% to $7,297.65 on Monday.

Like Lloyds, Virgin Money is concerned about customers running up large debts following a sharp fall in the value of digital currencies.

Over the weekend, several of the biggest issuers of credit cards in the US also banned customers from using their cards to buy digital currency.

The list of financial firms included Bank of America, Citigroup, JP Morgan, Capital One and Discover.

Lloyds’ ban, starting on Monday, applies to its eight million credit card customers across Lloyds Bank, Bank of Scotland, Halifax and MBNA.

Lloyds said it would not be contacting its customers either digitally or through the post to inform customers about the change to its credit card policy. Customers will only be informed should they query a blocked crypto-currency credit card transaction.

- What is Bitcoin?

- Lloyds bans Bitcoin credit card buys

- What’s the fuss about Bitcoin?

- From high school dropout to Bitcoin millionaire

Explaining the ban, a Lloyds spokeswoman said: “We continually review our products and procedures and this is part of that.”

The BBC asked other major banks about following Lloyds’ move, but none had so far responded. The banking trade organisation UK Finance said it had not released any guidance on the matter.

Gillian Guy, the chief executive of Citizens Advice, welcomed the announcement by Lloyds, saying it “shows they recognise the risks of credit card customers running up debt they can’t afford,” she said.

Barclays told the BBC that at present, UK customers are able to use both their Barclays debit cards and Barclaycard credit cards to purchase crypto-currencies.

“We take precautions to assess affordability before extending credit, flag and prevent any suspicious transactions and also closely monitor credit risk,” a spokeswoman said.

Bitcoin down

Bitcoin ended last week down 30% at $8,291.87 – its worst week since April 2013 and far below the $19,000 it reached last November.

However, the crypto-currency is still ahead of the $1,000 it was trading at this time last year.

Police have warned that digital currencies remain popular among criminals as they can use them to evade traditional money laundering checks and other regulations.

Recent reports from Chinese state media indicate that the Chinese government is seeking to tighten legislation to prevent investors in the country from accessing overseas exchanges to trade in crypto-currencies.